401k Roth Catch Up Limit 2025. The 401(k) contribution limit for 2025 is $23,000. This limit will likely be adjusted.

The roth 401(k) contribution limit for 2025 is $23,000 for employee contributions and $69,000 total for both employee and employer contributions. According to the irs, the 2025 maximum amount you.

The irs has increased the roth 401(k) contribution limit to $23,000 for 2025, up from $22,500 in 2025.

SelfDirected Roth Solo 401k Contribution Limits for 2025 My Solo, This is an extra $500 over 2025. The 401(k) contribution limit for 2025.

401k Limits 2025 Roth Lacee Mirilla, The 401(k) contribution limit for 2025. In 2025, employees and employers can contribute a.

Roth Limits 2025 Theo Ursala, These were announced by the irs on november 4, 2025. 2025 401k contribution limit and catch up the 2025 contribution limit.

2025 Roth 401k Limits Moira Lilllie, 401k contribution limits 2025 catch up even if you contribute 5%, the employer still only contributes 3%. The irs has increased the roth 401(k) contribution limit to $23,000 for 2025, up from $22,500 in 2025.

401k Contribution Limits 2025 Catch Up Over 50 Dacy Rosana, Roth 401k 2025 catch up contribution limit irs. The irs also sets limits on how much you and your employer combined can contribute to your 401 (k).

2025 Roth Ira Contribution Limits Allix Violet, The roth ira contribution limit for 2025 is $7,000 for those under 50, and an additional $1,000 catch up contribution for those 50 and older. The irs also sets limits on how much you and your employer combined can contribute to your 401 (k).

401k 2025 Contribution Limit With Catch Up Aggy Lonnie, 2025 irs 401k limit catch up. In 2025, employees and employers can contribute a.

401k Limits 2025 Catch Up Age Birgit Steffane, The irs also sets limits on how much you and your employer combined can contribute to your 401 (k). For 2025, the employee contribution limit for 401(k) plans is $23,000, up from $22,500 in 2025.

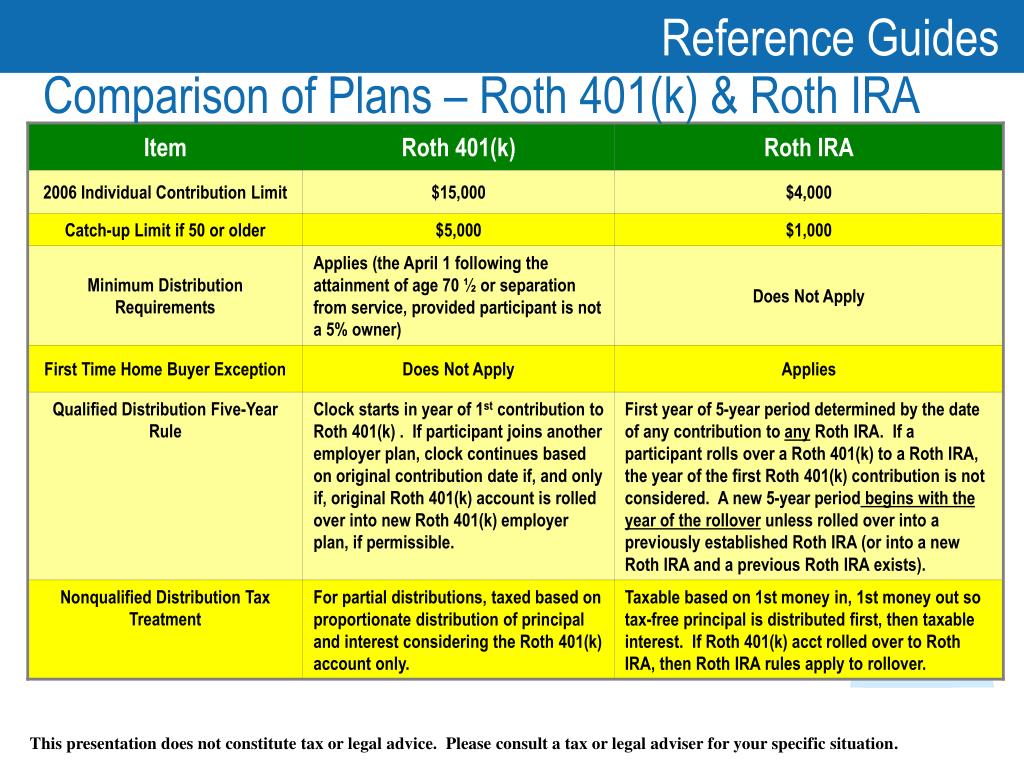

PPT Understanding the New Roth 401(k) PowerPoint Presentation ID510897, These were announced by the irs on november 4, 2025. The 401(k) contribution limit for 2025 is $22,500 for employee contributions and $66,000 for combined employee and employer contributions.

What’s the Maximum 401k Contribution Limit in 2025? (2025), If you're age 50 or. In 2025, for people under 50 years old, this limit is.

The irs has increased the roth 401(k) contribution limit to $23,000 for 2025, up from $22,500 in 2025.

Roads Scholar Trips 2025 Costa Rica. Our 2025 campus of the year. Explore 860 trips from road scholar , with…

Hybrid Suv 2025 Toyota. The best hybrid suv of 2025 and 2025 ranked by experts. As the hybrid suv of.…

2025 Paint Colors For Living Room. Ahead, explore the major themes and colors that are expected to take. A chic…